PRESS RELEASE

- David Rubenstein leads a diverse investor group that includes Michael Arougheti, Mitchell Goldstein, Michael Smith, and Maryland leaders, philanthropists, and sports legends

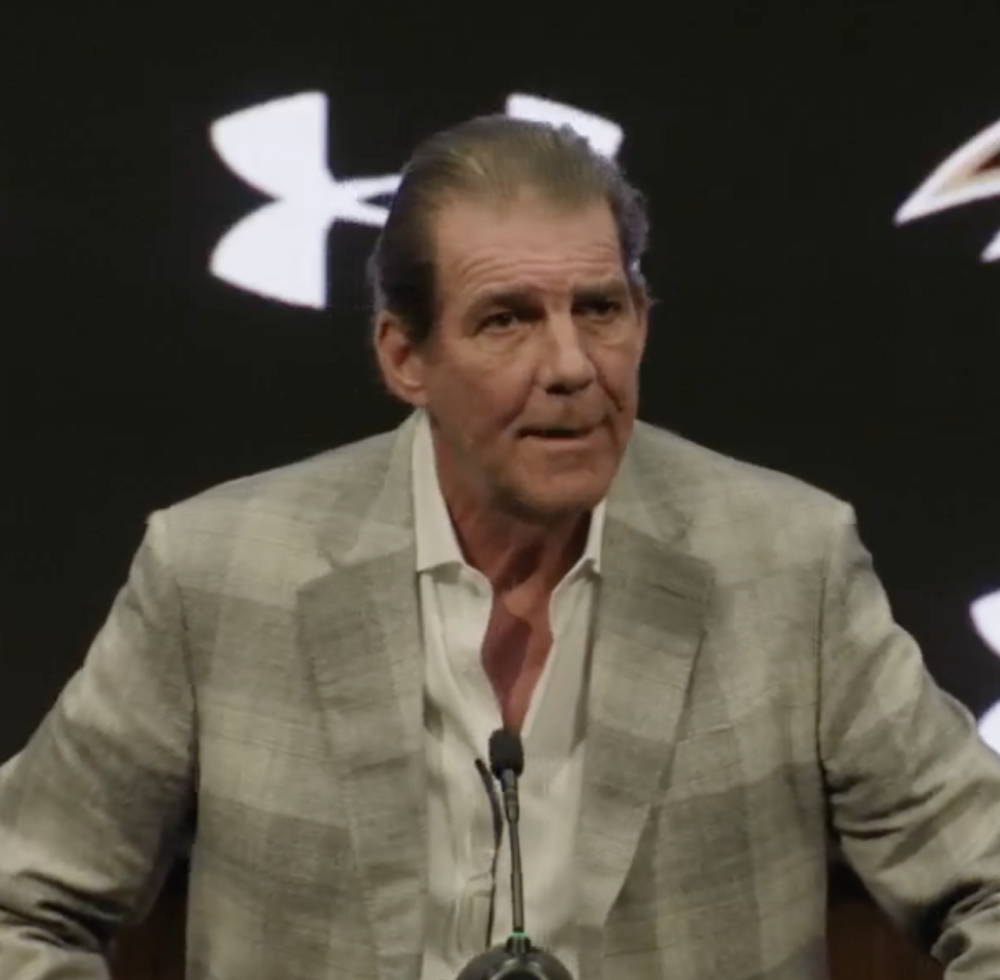

- David Rubenstein to become Control Person of the Orioles

- The Angelos family will continue as a major investor, and John Angelos will work with Rubenstein as a senior advisor

- Transaction values the franchise and assets at $1.725 billion

Baltimore, MD – The Angelos family, majority owner of the Major League Baseball (MLB) franchise the Baltimore Orioles, has agreed to sell a control stake in the Orioles to Baltimore native, philanthropist, and investor David M. Rubenstein for $1.725 billion. The Angelos family will continue to hold a sizable investment in the Orioles, and John Angelos will serve as a senior advisor to the organization. The transaction is subject to review and approval by MLB’s Ownership Committee and a full vote of MLB ownership.

Mr. Rubenstein is Co-Founder and Co-Chairman of The Carlyle Group and he will become the controlling owner of the Orioles upon the close of the transaction.

Mr. Rubenstein is joined in the investment by Michael Arougheti, Co-Founder and Chief Executive Officer of Ares Management; Mitchell Goldstein and Michael Smith, Co-Heads of the Ares Credit Group; Cal Ripken, Jr., Oriole’s legend and MLB Hall of Famer; Kurt Schmoke, former Baltimore Mayor; Grant Hill, NBA Hall of Famer; Mike Bloomberg, entrepreneur and philanthropist; Michele Kang, business leader; and other investors.

John Angelos said, “When I took on the role of Chair and CEO of the Orioles, we had the objective of restoring the franchise to elite status in major league sports, keeping the team in Baltimore for years to come, and revitalizing our partnership group. This relationship with David Rubenstein and his partners validates that we have not only met but exceeded our goals.”

The Orioles’ major league roster and minor league team are stacked with young talent. For example, in a first in MLB history, the O’s have the #1 prospect in all of pro baseball (Jackson Holliday) for the third year in a row, following Gunnar Henderson (No. 1 in 2023) and Adley Rutschman (No. 1 in 2022), and have five of the top 32 rated prospects in all of professional baseball. In 2023, the Orioles won the American League East for the first time since 2014 and the Orioles had more wins (101) than in any season since 1979.

The Angelos family will remain a major investor in the Orioles after the close of the investment. “I am personally committed to helping David and his partners take the franchise to the next level,” Angelos added. “We think this transaction is great for Major League Baseball and great for the City of Baltimore and Maryland. We are thankful to the fans and supporters cheering on the O’s as we reached this important goal – and who will be with us celebrating more success to come.”

David M. Rubenstein said, “I am grateful to the Angelos family for the opportunity to join the team I have been a fan of my entire life. I look forward to working with all the Orioles owners, players and staff to build upon the incredible success the team has achieved in recent seasons. Our collective goal will be to bring a World Series Trophy back to the City of Baltimore. To the fans I say: we do it for you and can’t do it without you. Thank you for your support.”

He added, “Importantly, the impact of the Orioles extends far beyond the baseball diamond. The opportunity for the team to catalyze development around Camden Yards and in downtown Baltimore will provide generations of fans with lifelong memories and create additional economic opportunities for our community.”

Goldman Sachs & Co. LLC is financial advisor and Jones Day is legal counsel to the Baltimore Orioles Limited Partnership; BDT & MSD Partners is financial advisor and Wachtell, Lipton, Rosen & Katz is legal counsel to David Rubenstein; PJT Partners is financial advisor and Hogan Lovells is legal counsel to Michael Arougheti, Mitchell Goldstein, and Michael Smith.