Our defending champion of sports business valuations and the whys and hows of billionaire owners, Kurt Badenhausen of Sportico joins Nestor once again to (finally) discuss the exit of the Angelos family and the financial realities that David Rubenstein and new ownership inherit with the Baltimore Orioles. And the media and sponsorship landscape for Catie Griggs to take $600 million of your money to grow Camden Yards and an All Star Game into a cash machine that stimulates payroll growth…

Sportico business evaluation e… and MLB ownership with Nestor

Wed, Jul 24, 2024 11:42AM • 35:24

SUMMARY KEYWORDS

money, orioles, years, people, valuations, sports, franchise, camden yards, sold, rubenstein, run, baseball, revenue, nfl team, pay, point, baltimore, nationals, nfl, owners

SPEAKERS

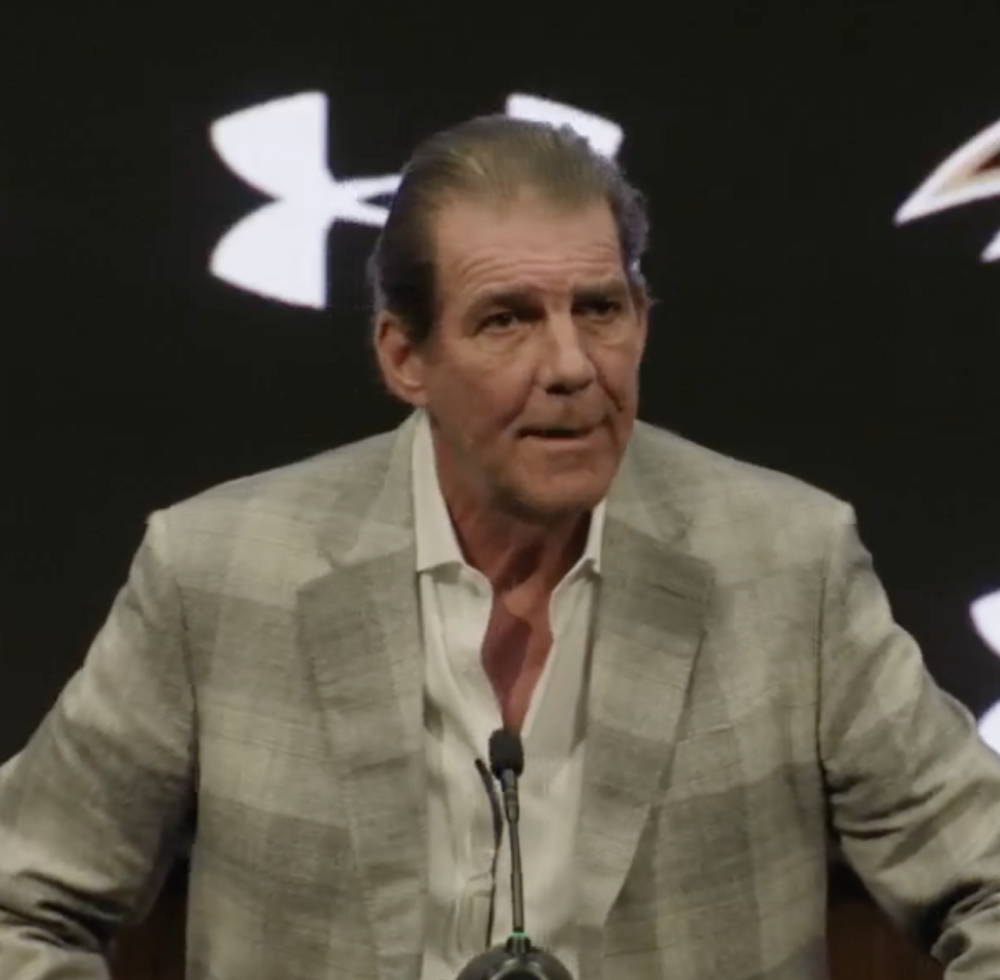

Nestor J. Aparicio, Kurt Badenhausen

Nestor J. Aparicio 00:01

Welcome home we are W n s t, Towson, Baltimore and Baltimore positive. We are taking the Maryland crabcake tour out on the road. Just want to wear my state fair gear. We’re going to be out on August 13. With potential new senator Angele author Brooks, who was the Prince George’s County Executive. She’ll be with us in the afternoon at State Fair in Catonsville, we’ll be giving away the Gold Rush sevens doublers from the Maryland lottery, our friends at Liberty pure solutions will be on hand with my clean water as well as Jiffy Lube. MultiCare getting us out on the road. Luke is on the road to Owings Mills down to the ballpark back and forth covering the Orioles and the Ravens. I get this guy on maybe once a year, twice a year if I’m lucky, and he has a funny title. And it’s so nerdy and I love it so much because it’s the most important thing I think we can figure out is what these teams are getting from us and their ownership is getting from us and we’ve gone through an ownership change that felt like it was about three decades over. Over time. I got to know Kurt Baden housing a little bit in his previous employer. He’s now at sportivo doing sports valuation. We’ve come a long way. We’ve lost sports, beat writers and all sorts of ways. We have a sports valuation reporter at politico I know he loves that title so much her Welcome back on man, you always make news when in the business community when these things because they only go up as Mr. Rubenstein has pointed out, and you sort of make news is this but this is a like a life or project term paper for you. You’ve been at this a long, long time. I’ve

Kurt Badenhausen 01:30

been at this a long time. 30 years, since I got out of college. And we first started doing this at a place called financial world

Nestor J. Aparicio 01:38

to make your hair grow. Look at you, man. Yeah, lost

Kurt Badenhausen 01:40

a ton of it. And it’s made it very gray. So the obviously a lot has changed over 30 years. 30 years ago, you pick up a sports team for less than $100 million, basically across cross outside of a handful of NFL teams. There was no business there was not these were not businesses. These were kind of mom and pop shops. Run typically by longtime owners who collected a few dollars from tickets concessions, got some money from TV, maybe sold a sponsorship or two. Now,

Nestor J. Aparicio 02:14

Hero got to be civic hero was a big part of that and what whether it was egotistical or magnanimous that was part of all of the gentlemen’s club of sports in the 50s and 60s, it was all white men, let’s be honest. Well,

Kurt Badenhausen 02:26

ya know, 100 100% corporations weren’t really interested in it because the businesses weren’t big enough bankers weren’t interested in it because the business wasn’t big enough. Now, here we are. Sports is an asset class, which drives people crazy. The drives the fans crazy, they just want to be fans. And they don’t care about all this stuff. But the reality is, it is an asset class. Now valuations have gone crazy. It’s attracting all sorts of institutional investors. It’s a attracting all of these financial type people like David Rubenstein, who are seeing these, again, there’s a civic component to it. Absolutely, still, but these are real businesses now, and hence they have multibillion dollar price tags.

Nestor J. Aparicio 03:09

Rubinstein appeared on Squawk Box a couple of weeks ago, he won’t be sitting down with me in any authentic way. So I fair enough, it is what it is, you know, he just bought the team, we sit here talking about the team last 33 years, every day of my life, as you know, you know, I’m not owed anything. But I think the civics part of the expectation of $600 million coming to their stadium and what you will be talking about in the next couple of minutes, when it comes to how much money they’re making. But he was on Squawk Box, and this was my entree to him, because I really didn’t pay attention to him at all. Because I wanted to meet him I wanted to, like make my first judgement, not when I saw the press conference or his television show about nerdy money or whatever. I’m like, you know, why? Why did this cat get involved in this? And he said, he’s trying to get money, right? He’s trying to get money from other people like him in this era Getty cat to give him money. He’s been on a little bit of a tour to try to generate money to pay off what’s left of Mr. Angelo says $1.8 billion thing. And he said, No one’s ever lost money, investing in sports that says, Come on. That’s a sales pitch. And then he says, I did this as a philanthropy and then within 10 seconds in the same sentence, he said, Of course we expect to make money. I don’t, I would have probably pressed him on that as a journalist. But that being said, Why what is so good about this, that Michael Eric Getty, who you know, went and bought beers to be famous on opening day and runs into hot dog races that are with his kids? What’s What’s the jam for these guys other than box seats and to say that they they ran into Kentucky Derby and they bought part of the horse?

Kurt Badenhausen 04:49

Well, it dramatically escalate your profile. It doesn’t matter your if you’re the founder of one of the largest private equity firms in the world. A lot more people know who wrote who David Rubenstein is now than they did before he bought the Orioles you look at a guy like Shawn Cohn, very successful businessman created a giant auto parts supplier sold it for multiple billions of dollars nobody know who shot Khan was he bought the Jacksonville Jaguars and people like, you know, the funky mustache. Everybody knows shot con now. So the reality is it raises your profile. That has some advantages to it some disadvantages too. You got to take some slings and arrows from the media and the fans, but mostly shotty

Nestor J. Aparicio 05:33

always hated that he wanted to have the team without being famous. And yeah,

Kurt Badenhausen 05:37

yeah, yeah. And there are there are there are owners out there like that. But though they’re there, they’re unusual. Most of them like the high profile being the face of these franchises. And he is true, I wouldn’t say it’s it’s not a verbatim every single sports franchise is sold for more you can go back to famously gotta go back a long time. The CBS sold the Yankees to George Steinbrenner lost money on the deal. And then also Bob Johnson when he unloaded that what became the Charlotte Hornets, again, to Michael Jordan, also for less than he paid for it as an expansion. But outside of those two examples, the line goes up into the right. And and and particularly for the NFL and NBA, it has been a massive escalation in values. MLB not so much because it’s such a local business and so you don’t get that gigantic check from the league. Your local business really drives everything. And for clubs like the Orioles who, you know, I mean, at one point were literally at the top of the Echelon they were at the top cream of the crop up there with the Yankees. I mean, they were a top five franchise in the league financially after Camden Yards open top five franchises in terms of value, revenue, you name it. But as everybody else started building stadiums market size came more into play Oreos had trouble drawing fans. Camden Yards got a little older. And here they are team stone,

Nestor J. Aparicio 07:10

the teamstuff the team stone BFN stuff coming. Yeah, absolutely. Bill DeWitt had his paws on this team all these years ago I wrote about in the Peter principles and it’s all factual. Bill DeWitt and what St. Louis the stability St. Louis has shown, it would have been very, very easy for the Orioles to have been the Red Sox of the East. During that period of time, had it been well managed to your point it was mismanaged and then cashed in angrily for Masson and the DC thing. What does Rubinstein inherit here, Kurt? I mean, like to me, he bought this thing. Yeah, he ain’t going broke. And but what what does move this to another level in hiring Katie Griggs in from Seattle, you do valuations on this, what makes this a more valuable property other than Adley rutschman and a few home runs and a few World Series parades, but making it well managed from a business model because we’re going into a place with baseball where they have no idea where this revenue is coming from. They really don’t. You’re

Kurt Badenhausen 08:09

buying a distressed asset. Honestly, with the Orioles because of how mismanaged it’s been there’s no reason it shouldn’t be a $2 billion plus franchise. Because if the team draws consistently able to generate more revenue from the stadium, the biggest cloud overhanging the club obviously is Masson and its relationship with the Nationals hat, you know, the how those funds are going to be allocated in terms of REITs fees they’ve settled, had been in court for a decade now. They they’ve settled, the REITs going back, good. I don’t know what the exact time period going back.

Nestor J. Aparicio 08:47

Very, very blessed that your name’s not Eric Fisher, some of my other mafia that I had to call every three months when there was another mass in arbitration dispute, because I know you were in on it on the outside keeping an eye on it, but imagine having to explain that to yourself, you know, to people for 15 years around here as to why the Orioles would punish themselves put a poison pill in a contract that would restrict artificially restrict our own revenue to make their baseball team better to enrich the owner on the media side. It was an astonishing player and then scream with his arms up on being robbed the whole time. Like it was an amazing play the last 20 years and Mr. Angelo’s life here really

Kurt Badenhausen 09:28

well it’s and again, it complicated the sale the Orioles and obviously complicated the sale of the Nationals. Because people are kicking the tires on both of these franchises, and realizing this cloud is over. There’s a massive overhang on both franchises. So we don’t know how it ultimately will be sorted out. But the Orioles obviously have a good foundation should be a very good franchise attendances up. They’re going to have massive stadium renovation that will help modernize the stadium. And obviously create more revenue generating opportunities. And if this is a franchise that can draw 30,000 Plus fans a game with a good ballclub make the playoffs that helps sponsorship, all those other components, the local TV thing is still TBD very much. But you can be you should be a $2 billion franchise. With those kinds of demographics.

Nestor J. Aparicio 10:26

Parbat Nelson is our guest, he is the sports valuation reporter but so much more than that at sportcoat. He comes on and talks money with us it talks valuation. We’ll get to local TV, TBD. I’ve written that down. I’ll come back to that. But I want to come back to Rubinstein and the intentions of a 74 year old guy to dance on the dugout and squirt the fans and give away hats and come out and you know where the old man hat look like Steve Martin, and for all of these people that get involved in this at this point, depressed asset getting $600 million to fix their house up coming into a good situation with it. So let me sign me up. How do I get I get some money to get it on that I think I can’t lose on. And you know, I don’t see people running toward this. But these things are getting valued to the point where regular people, no no person can do this on their own just to about $2 billion to buy teams, that it’s become exclusive to the exclusive point and also corporate to some point where there are these, there are people that have any thought about the community and baseball is all about the community to your point like they have to figure this out from the ground up. Maybe the way hockey did forever, not you know having money and through. I don’t want to call it a niche sport, because I guess it is I look around everybody’s white baseball games. So I guess it his niche to some degree, but trying to figure out how to absolutely squeeze every nickel out of something where they have so much inventory. And I think the first thing is just to your point, local TV, local TV is TBD. I’m wondering what the package comes to me. And is it 250 A year 350? A year five? How much? Are they going to try to get just to have the games on my television? And then when they sell the rest of it off to Apple and Amazon? Are they even gonna have any exclusivity to be able to do that? Because it feels like that’s, that’s the revenue model right is making me pay to watch it on television? Well,

Kurt Badenhausen 12:21

the revenue model has been collecting money from people that don’t watch it on television. I mean, that’s been the golden goose all these years all these people paying their cable bill that never watched an Orioles game, but they still pay for Masson every single month as part of their cable bill

Nestor J. Aparicio 12:37

350 sub six states in one at one point, you know, Nags Head, North Carolina. I mean, they had quite a little empire.

Kurt Badenhausen 12:44

That was an incredible business model. And that’s why these rsmeans When these deals were done, and teams were getting equity in the RSN. And they thought this is again, literally the golden goose or equity in this thing’s worth a billion dollars, we’re gonna get $80 million a year and REITs fee,

Nestor J. Aparicio 13:02

it’s important to beat up Comcast and they’re gonna have to put it on and pay a surprise, the

Kurt Badenhausen 13:07

equity and all these things now is zero outside of maybe the Yes, network, Nas and a couple other big market franchises but mass in there, there is zero equity in terms of what that RSN is worth right now. And because it can’t be an ongoing concern in five years, probably not basically

Nestor J. Aparicio 13:27

when I wake up the next day, and it’s still on TV, and I turned the TV on. They’re like playing high lie. They’re racing animals. I’ve never seen it, you know, it’s like I don’t even know what’s going on. Like it’s and it was supposed to be this incredible generator and shining light for the brand. And they couldn’t afford to put spring training games on man, you know?

Kurt Badenhausen 13:47

Yeah, yeah. No, it’s it’s it is, it is still very much TBD. Because to make up for all those people that are paying for it that aren’t watching. To your point, the fans who watch the cost, you know, is going to be something hundreds of dollars. And then to your point, you bring it in, then are streamers going to want this i at MLB, they do not want to cast aside the linear component of it the RSN because those still provide a lot of revenue. And for the big market franchises, they’re not what they’re not looking to give up. They’re streaming their model, right. They love their model. It’s profitable for them.

Nestor J. Aparicio 14:30

Just cut half their fans out and still figured out how to make billions of dollars right.

Kurt Badenhausen 14:37

The Dodgers have over $8.35 billion TV contract really helps when you’re going out to sign players and even in a deal Yeah, to your point that is not in against see it in half the market. So this is why this thing with diamond sports is dragged on. I mean, because it is so messy. There’s so many entities involved. It’s mass in times 15 Right At MLB, you know, in MLB is at the center of the NHL and NBA kind of on the periphery, they’re ready to move on do their own thing. NBA is about to sign a gigantic deal. Justin’s gonna have a few complications. It appears

Nestor J. Aparicio 15:16

just what Charles Barkley just figured him out. Right?

Kurt Badenhausen 15:20

So it’s baseball is in is in a challenging spot from a TV standpoint, because it has been the foundation of their economic model, that that big TV, right, because baseball, you’re right, there’s so much inventory. That’s what made it so perfect for RSS, because you played 162 games a year. You’re not saying

Nestor J. Aparicio 15:41

content, we need content live. Now you can bet on it. Oh, my God, everybody’s gonna want it. I don’t know. I mean, we’re winning here. And I’m trying to measure how they’re gonna play clinch games in September. And there aren’t just 17,000 fans running around like it’s major league or something like, when is it going to really get vibrant here financially, and we have the problem in this market. And you talked about depressed asset, maybe the word Baltimore and I’m Baltimore positive Kurtz, as you know, but you know, I also sold the condo that you’re looking at, this was the view from where I live for 19 years, I sold it for a quarter of a million dollars less than I put into it. So depressed assets all through downtown and through the city. And we talk about the city trying to come back and the bridge going down. And the crazy stuff that’s happened here, not just here, but in the country in general, politically, and otherwise. The fact that they got $600 million for both of these owners, no one blank, no one voted on it. No one said a word about it’s just we’re gonna build a black wing into the stadium and build the shinier perimeter clubs have more high profile, exclusive, exclusive exclusivity, they weren’t exclusives in every word for the $600 million. A citizen spent, the baseball team better figured out so it’s not so exclusive. Because I’m telling you, I’ve been here my whole I got long hair. I’m from Dundalk. I know. I know this community that works things this big and that we don’t have a lot of rich people here. And we certainly don’t have like these fat cat wealthy companies that are just going to underwrite all of this, which is one of the CASAS bitches through all of this is we didn’t have enough big money around here. And it’s really when you mentioned the glory era of Oreo baseball and I did write a little bit of a book on this the first 10 years of the club suites at Camden Yards when there was no football when there was fear of losing baseball when Washington was trying to get baseball when Washington companies and George Will and Larry King and we’re all up here and like all that was Bill Clinton’s up here thrown at the ball like all that went away with a mismanagement they lost all this guy so and then they get to give it all to the nationals. And that’s never coming back. So when Mr. Rubenstein buys this depressed asset, I really do wonder this isn’t Willy Wonka. There’s no glass you know, there’s a ceiling here and I don’t know where it is or where the bean counters in your world valuations. Look at this kind of a franchise and why Rubinstein bought this instead of the Nationals. I’m thinking because he could claim the Baltimore part of this although he’s had a lot to do with Baltimore ever since he left but but it had to network and I think there was and it was available the Nationals word, but I’m just trying to figure out his real play in this and what the exit will be. And what the real strategy of fixing my city is because that’s my stake in it. My My stake is the poor dude, I sold my condo to that he doesn’t sell it for a quarter million less than I sold it to him for because we’re trying to resurrect the city and I think that’s at the heart of everything. That one of the reasons I bug you, brother, you know? Yeah, yeah,

Kurt Badenhausen 18:39

no, I you raise, you raise a lot of selling points. And it’s the reality of the situation when the club was on the market. And you talk to bankers, that like I go down to Baltimore and drive around, but it’s a tougher sell for some of these billionaires than some of these markets. So there is there is definitely a ceiling. The Oreos are not returning to a top five market they’re not gonna be a top 10 market. You know, you’re talking about the middle of the pack in terms of MLB from a financial standpoint that that is at this point. That’s the ceiling for what we’re talking about with Baltimore. And in terms of nationals versus Orioles. You know, if I’m a 74 year old guy, I think I’d rather own the Orioles for the next five years instead of the Nationals. I think I got a better chance of raising a trophy with the Orioles then then the Nationals

Nestor J. Aparicio 19:38

but anybody be telling you can make more money with the National theoretically Theoretically, yes,

Kurt Badenhausen 19:43

no, I’m 100% the nationals have also not been managed very well. They’ve had they’ve been impacted by Masson 100% But but certainly have have made some questionable decisions in terms of player make up and how the team is marketed. So there is a lot of upside there as well. Ted Lerner seems to have, you know, be the lead horse in terms of buying the franchise if can ever excuse me, Ted leonsis. If we can ever settle on a price with the learner family seems to be the lead guy. But

Nestor J. Aparicio 20:25

that’s all about media to your point. That’s all about, like, I’m gonna get the rights back when I had my hockey team, my basketball team moving to Virginia, maybe if I want to probably not, oh, I never meant that. She did not like to do the lack of integrity. I just see across all of this. They threw me out. And I’m like, do I really need to be in a room full of lying billionaires, you know what I mean? Like, and then I have to carry their water. Like it’s insane. I but it really is what but I’m trying to figure out what I’m getting with Rubenstein and what our level of expectation should be of what new ownership represents because it already feels better than Angelo’s because it is what it is. But it’s times like this and reached like this, where I call you and say, well, there’s a trading deadline and assets and asset management of young players that are under team control. They’re thick, they’re gonna go get Scoble, and give away a bunch of young guys, these are the young guys who have to backfill if they can come to terms of rutschman. And Henderson, and they don’t have to walk over $50 million, so that this thing can be sustainable, and not what Kansas City was, or what some other places where the five year Manford plan. Dude, I live in Baltimore, I don’t want a five year plan and the place is empty and 31. And nobody wants to buy the cable package and then it’s on life support. Because it feels to me like people stopped buying cable. I watches my Miami Marlins game this week. I’m like, I don’t care what I’m selling, I would not want to have to sell the cable package, the WWE package for the Miami Marlins to a fan base that is non existent. Well,

Kurt Badenhausen 21:53

you have an ownership group, though, with very, very deep pockets from lead owner down through the Myron Hart LP, what does that mean they use it? Well, that’s That’s the million dollar question we’ve had, I think you’ve had billionaires, you know, billionaires become billionaires, because they don’t waste money. Now, I think some of these guys are at a point maybe in their careers where their life. So the reality is, you don’t make a lot of money on a year to year basis in baseball, I don’t care who you are, I mean, if you want to, if you want to generate good cash flow, owning a sports team outside of an NFL team is not the place to do it. If Dodgers Yankees cubs, they’re not generating significant cash flow versus the revenue that they have. The margins are really small on these business. So for the Oreos are the, you know, the idea of making a 20 $30 million profit versus, you know, putting another 30 million into payroll and breaking even, right? These guys are smart businessman, they should know that to build this asset where ultimately you’re gonna have you know, your biggest payday is to build this asset up and to have a successful franchise again. That’s where you’re going to make your money, not on a year to year basis in terms of generating net income.

Nestor J. Aparicio 23:17

You know, I saw on that piece that Mr. Rubenstein did on Squawk Box. I mean, he hope began the whole thing by talking about his great friendship with Biden, you know, it used to be a Democrat, but now he’s independent, but he just interviewed Trump and sat down with Trump and Trump made some points. And who are you voting for? Why not political he said at any way I’m not political. And I I charge this was my introduction to first watching him about that a month ago he did this piece right after the world’s lost a bunch came with the with the Astros and I looked at it and I thought to myself, this is this felt slippery to me as a journalist that a lot of ways and accountability wise, but it really does feel like there’s the money that these things are generating becomes significant because they have to be in counted. Katy Griggs is going to have to be responsible for it. But the NFL with your reporting, and I want to move the conversation a little bit toward that. I’ve had two reporters come on this week and say it’s idiot proof to run an NFL team because the money’s just falling off the truck everything I’m reporting with the Orioles and this is one of the reasons I’m holding all of them accountable is You better work your asses off on figuring this out because you could sign Gunnar Henderson for 50 million and say, well we’re just rich we’re giving money away the way the Padres owner did God rest his soul and the Tigers in illage ran it like that. But baseball doesn’t usually run that way these wealthy guys I don’t think they run that way. Maybe their egos are that large the way Steinbrenner would sort of get all in baseball is a plus you can get all in football you can but football is just printing money off the side of a truck that makes it so easy for them to be as arrogant whatever they want to be baseball you better be a little nicer because they to your point. This is a hard business baseball is a hard business selling

Kurt Badenhausen 24:59

at You want games a lot harder than selling 10. And so that that’s the challenge that baseball always says NFL is easy. As we had, we didn’t invent less, or invest in sports event last fall, bankers on stage say my golden retriever could run one of these NFL teams, it’s, you get a check. As we wrote about the national revenue a few weeks ago, right before the pie, excuse me, packers put out their annual report, check, every team got a check for $402 million last year, before they sold a ticket. Beer sponsorship, you name it, that was the check from the league salary cap, I think was 235. So that’s a nice little cushion to play with. And then you add on local revenue on top of that. So the NFL is an absolute machine. Nobody ever sells the average ownership, 10 years, 40 years. So anytime one of these things comes on the market. Price goes through the roof. I mean, we’ve seen the Step Up Carolina 2.3. Denver, 4.6, Washington, 6 billion. But we’re reaching a threshold where we’re running out of rich people to pay these things are during the NFL, there’s no institutional money allowed. They will change that I think this fall barring some sort of huge complication, but will only be 10%. So you still got to come up with the other 90%. And Josh Harris is able to do it because he’s made people billions of dollars over the year so he can go out to them and say, hey, put some money into this thing I’m doing well, that

Nestor J. Aparicio 26:33

was what the thought of Rubinstein was that he would be easily be able to bring his own partners in which he hasn’t been able to do with Carlyle. And just it would just be easy money, that this was a good investment because he was getting involved in and he wouldn’t get involved in anything bad.

Kurt Badenhausen 26:49

MLP is different than NFL it’s not a it’s

Nestor J. Aparicio 26:55

one year a couple years ago devalue the Orioles in your valuation weren’t one year they regressed.

Kurt Badenhausen 27:02

Yeah, yeah, we hadn’t go down, which is unusual. So Greg, I mean, that was bad was back in coming off of the COVID year. So that was things were dicey in MLB, they got hit very hard, because they were about to kick off their season. And so they ended up only playing a 60x 60 game season. And there weren’t fans there. And this is this is, as we talked about, this is a local business. That’s what drives this model. So the NFL, NFL, of course, did better than anybody because they got to collect all their TV money during the during the COVID years, baseball got hit really hard. And these people piled up significant losses. You know, I teams posted $100 million losses during the COVID years. So it was definitely a tricky business. And it certainly impacted the valuations. Because there it was not clear how quickly this was going to bounce back. Back

Nestor J. Aparicio 28:00

in 2014, things got good. Adam Jones grabbed me on the field with the all star game up in New York City field and said why is the old guy hate you so much. And the owners, you know, after free, the free the birds was eight years before that. And I said you expect me to answer that in 30 seconds. So I wrote him a book I wrote the Peter principles. And in the first chapter, the whole thing was de WITTs money, and he was going to get the team Eli Jacobson receivership. All this money was sitting in the bank, because Camden Yards just threw off $45 million of profit in its first year because it was full all the all star game all clubs.

Kurt Badenhausen 28:39

Live in Washington. It was there. Okay, so, yeah,

Nestor J. Aparicio 28:43

so I saw all of that Angelo’s bought the team in that courtroom that day, he only had $29 million of cash. A lot of that money that was due to him from asbestos was coming it was it was a waterfall that was on its way not money that was sitting in his bank account. He was not a made guy. He was on the make guy. And this was his way to save the world. Save the city, grandstand, do all that he blowhard all the things that he was, but the story that came to me that’s the best story are the courtroom stories in that August hot day where his wife was in there. Just could not believe that, that this family that had a bar in Highland town was taking all of their money $173 million, which was a fake price curd, that we came with $45 million, and it came with $45 million in cash. So it came with this vault of money that Eli Jacobs couldn’t touch because of the bankruptcy, and she was ashen faced and Angelo’s overbid. He didn’t have the money. He just was bullshitting basically, and did not have the money put the paddle up said I got the money. I got the money and on the Way Out said to Joe Foss elbowed and said you’ll figure it out that’s what he and people in the courtroom told me that Peter’s wife was just she could not conceive that he would do this 29 million I just did the math 1.8 million are you reporting your seven whatever you and John ran report whatever it is, that was the outcome and they did everything possible to destroy the franchise and every single turn for 30 years and that’s what the family including the sons fight with everything awful like flat everything awful that ever happened here and that’s how much money they made I mean I’m telling you maybe Mr. Rubenstein John does so maybe you just can’t lose money though in this bro.

Kurt Badenhausen 30:43

You long term very hard to lose money owning a sports team and the Orioles have been a very profitable franchise over the years this is not a team that was bleeding red ink over all those years to they had the glory years and then then things we have got got bad totally slashed the payroll to the point where they were still a profitable franchise. So it’s an incredible credible investment for the family. And we’ve historically seen that you know where you’re talking about a 10x increase in the gross price but to your point didn’t didn’t certainly didn’t put up 173 million right off the bat he

Nestor J. Aparicio 31:24

didn’t have 100 somebody you know, he even said to me We it’s like a mortgage is what he said to me became a last thing because I know you gotta run all star game and knew how what does that mean? I mean, what is the value of that for them to start making money off of these other things that they’re going to create

Kurt Badenhausen 31:42

all star game and that is run by the league. But But the advantage for the local property is one helps a fan base folding that in it you can’t can’t give everybody access because the lead controls a lot of the ticket inventory but it’s a nice little perk whether it’s that weekend or the whole weekend or excuse me the the the two day thing with a home run derby and the game itself but it’s a nice thing for fans to be able to fold into season packages that you’re selling to go out and sell luxury suites and also to sell sponsorships it’s it’s a nice little just add on in terms of sponsorships to get people interested brings new people into the fold. So it’s it’s it’s an it’s a showcase for your building, you know, Camden Yards kick launched this new building spree by Major League Baseball and was the was the model for so many years for all the building activity that took place in the 1990s and 2000s. And I think this is a way to shine a spotlight back on the building, as well as the hometown players, all the young players that you know, they hope are the foundation and that they can pay for with these deals. But but it’s tricky because, you know, as as your results improve the way baseball is set up, your revenue sharing goes down. So, you know, it’s this, the lower revenue teams are propped up because they get such big revenue sharing checks from the Yankees Red Sox, cubs and Dodgers. Celebrity paid back in the day for sure. Right? Yeah. 100%. So it’s the all star games a nice little way to just kind of bring in new fans. But more importantly, new sponsors that you hope, do long term deals and stick around. Crypto

Nestor J. Aparicio 33:38

nauseam has been a friend of Australia back in his former employer for many, many years. But now it’s fortaco. Real quick and sporty could tell folks about sports.

Kurt Badenhausen 33:46

Yeah, we’re focused on the business of sports break a lot of news. We do our team valuations. Part of Penske media, which also owns variety Hollywood Reporter Women’s Wear Daily South by Southwest Music Festival. So we got tickets we got a lot of different avenues, partners that we work with, do a lot of we just did a variety summit with variety out in LA sports, sports and entertainment. And so it’s launched in 2020. And with a bunch of experience guys that came from Bloomberg and Sports Illustrated, I came for Forbes couple other people from Forbes so it’s we’re really digging star team all star team covering the business of sports. All you name it. NBA writes deals to Olympics to NFL team valuations. Breaking news, left and right. First

Nestor J. Aparicio 34:43

crabcakes on me when you get down here, we’ll figure out where and when. And all that stuff hurt by now. So now it’s fortaco Please go follow him. Really sort of the gospel of valuations and really the business and I love having you on I love the wise conversations we have to appeal this back. Africa it’s a it’s an interesting time for migrants and for the community and for downtown and how it all pieces together. There’s a lot of money being thrown out. We just wanna make sure it’s good money, dude, I appreciate you coming on.

Kurt Badenhausen 35:13

Thanks for having me on.

Nestor J. Aparicio 35:14

You got it. I am Nestor. We are wn St. am 5070, Towson Baltimore learning stuff around. You’re talking a lot of baseball looks at a training camp. Stay with us. We’re Baltimore positivebaseball, orioles, year, revenue, tickets, people, team, ravens, buy, game, payroll, money, yankees, marty, week, ownership, media, players, pay, point