Learning how to protect, grow, enjoy and transfer your money with our partner Leonard Raskin and his new book on your financial goals and who to trust to help you live your American Dream.

SUMMARY KEYWORDS

fiduciary, money, talking, life, baltimore, paid, long, insurance, book, people, baseball, life insurance, account, based, called, grow, raskin, investment, best interest, week

SPEAKERS

Nestor J. Aparicio, Leonard Raskin

Nestor J. Aparicio 00:01

Welcome home, we are WNS TA and 1570, Towson, Baltimore and Baltimore positive My oh my internet friends are saying I should have a click on me or click here or subscribe here or set your dial and one of your top six positions on your am radio dial to 1570. We’ve been doing this a long, long time runner. We’re having a very interesting month of March here we have a relevant baseball team we have a baseball team about the transition to new ownership or hopefully we get a spring training games on television be nice, a football team transitioning as well. And you know if you’re in the tax space, transitioning toward like on April 15 is right around the corner letter. Raskin joins us now I’m wearing my Raskin global shirt here as I do, you can go to rascal rescue global.com and learn about all that he does. You know, a lot of times we talk about yesterday’s football game, or tonight’s baseball game, or last night’s hockey game or Ovechkin or Helvetica. It looks like John Angelo’s based on what I saw over the weekend are resembling each other. But you have like a big announcement, right? Like later on in the month, I’m doing something cool here, about like 25 years of wn St. But like, you have birth your own child, you have a child, he’s a lot of money. But you’ve made the next baby. And you’ve made the same mistake that I’ve made four different times, and I’m re releasing my book. But the second book I wrote was in 2006, on my father and my father’s love of baseball. I’m releasing that on Tuesday, March 5, my dad’s birthday, march 5 would have been 105 years old. So I’m re releasing the book on my father’s love of baseball, and how wn St. got built. It’s 18 years old, Leonard says I get free the birds. Wow. And now all of a sudden out. You too, aren’t Altair?

Leonard Raskin 01:51

Hey, you know, you got to do it. After 36 years in the business of advising people what to do with their money. Our government? Well, back eight years ago, under the Obama administration, our government decided that they were going to tell people in our biz my business, that you have to be a fiduciary. Now that’s fine and dandy, and a lot of people claim that they are fiduciaries, what does that really mean? It simply means that you must act in the best interest of your client when it comes to advising them about their money. And believe it or not, in my industry, that’s not the standard. The standard the party made off was you know, the kind of shores right sure the stamp, but there’s lots of those, sadly, the standard is, it fits, it’s suitable. There’s a suitability standard, it’s called. So if if I were to make a suit of clothes for Nestor, the fact that it fit your body and hung on you reasonably well. I could say that’s a recommendation that you buy that suit, it doesn’t mean that it’s a really nice looking, fit well tailored up to your need perfect suit. It just kinda does the job. So along comes the government with this thing called a best interest standard. And now they’ve come all the way to everybody is going to be at some point, they’re going to pass this the Department of Labor’s passing this they’ve passed it, Trump said, No, Biden’s brought it back. It’s called the fiduciary standard is basically what they’re looking at. So I wrote a book and the books called fiduciary who, because lots of people in the industry that claim to be fiduciaries and that the government even claims are fiduciaries are very small, very small fiduciaries, meaning in my humble opinion, like if you’re an investment fiduciary, you have to have the best interest of your client when it comes to how you tell them and where you tell them to put their money. That’s fabulous. Okay, so you’re a fiduciary because you don’t earn commission. You’re a fee based consultant. And your clients account rises and falls in value and you get paid a percentage of the account that’s traditionally how assets are managed these days. There’s not a lot of brokers out there trading on commission on trades, that’s how it used to be. But now it’s mostly assets under management trade.

Nestor J. Aparicio 04:22

I always thought it was weird that a guy could take my money lose my money and still get paid. Yeah, but

Leonard Raskin 04:27

but that’s your hope that’s not gonna happen. But it happened a lot more when people were trading accounts and there were commissions on trades than when it’s an asset based account because you hope the asset manager and you have the same goal, which is to grow the account, because if it grows, they’re gonna get more okay because it’s a percentage of assets and they’re gonna get more money as the account grows, that’s what you want. And you want them to watch that account, manage that account, supervise that account, but here’s the point of the book. That isn’t investment, fiduciary, that person who managing assets almost never asks the investor about titling relative to their estate plan about insurance protections and is licensed and understands the nuances of how to protect someone from whether it be in a car accident, a home liability claim, a disability claim, a sickness, life insurance, I don’t have to tell you, you know, all too well, your wife, you know, had a tough, tough, tough battle twice. If, if we had talked 15. And when did she first get sick it was and we 10 years ago, next week, 10 years ago. So if we had talked 15 years ago, and I had advised you in your wealth planning, that part of that was to make sure you had sufficient life insurance that if something happened, and you had a premature death, that your family wouldn’t be financially wiped out, you could have said, Okay, or not, and that recommendation could have been implemented or not. But today, with a history of what she battled and how she battled it, you would agree, and I would tell you, it’s going to be damn near impossible for her to get life insurance, post her illnesses. And if she did, the cost of said opportunity would not be what you hear on the radio, million dollars life insurance for a penny a day or $1 a day because that’s for people that have never been to a doctor in their life and don’t have any health issues are super healthy, not for somebody who’s battled cancer twice. So an investment fiduciary is wonderful, if all you want to deal with is your investments. But if you want somebody that’s going to deal with the entirety of your financial being, from insurance, to wills, to your

Nestor J. Aparicio 06:49

point, everybody, the suit doesn’t fit everybody and what is suitable? Yes, we’re a steep shot. He’s a portfolio is not suitable for you or me. But

Leonard Raskin 07:01

even even that, though, is just an investment discussion. With Steve Bushati, I’d be discussing the same things we’d be talking about his insurance we’ll be talking about as a state plan, we’d be talking about his charitable concerns, we’ll be talking about the investments. My point is simply this the book is about that a fiduciary is much bigger than just an investment, fiduciary. And I know lots of great people that give great investment advice. The thing is, the government calls them a fiduciary. Well, the government doesn’t think people that sell insurance are fiduciaries because they earn a commission. And that’s tragic. Because it’s not about how you get paid that makes you a fiduciary. It’s the work you do that makes you a fiduciary. So I wrote the book called fiduciary who, it’s now available on Amazon, for anyone who wants to buy it and understand a little more about what we do, how we do it, and what our philosophy is to get out of my head and onto paper forever. what that’s about and what my beliefs are and how we do this thing called financial advice in a different manner that too few people do well. Well,

Nestor J. Aparicio 08:12

I was gonna say like, when I got to know you a little bit, I was like, not tell me exactly. So what is your elevator speech for someone they go to Rascon global, but I you know, you and I talk a lot of football out of baseball, yeah, about sports and life and music and Lord of the city, you know, what a politics talk about, but like the basic elevator speeches, that you are different than my Merrill Lynch guy, absolutely,

Leonard Raskin 08:36

we could be part of what we do could be your Merrill Lynch guy. But first and foremost, we are a fee based firm, that charges for the wisdom we have of how to handle your money, in its best capacity to give you the life you want. If you’re an individual investor, if you’re an executive, if you’re a professional, we want you to maximize the efficiency and effectiveness of your money in ways that nobody else is telling you how to do. So that you have the life you want for the rest of your life and forever and for generations beyond if you’re a business owner, we’re going to do those same things, but we’re going to help you have the life you want. Inside and outside of your business. Too many business owners spend so much time on their in their business and on their business. That this month,

Nestor J. Aparicio 09:22

by the way, this must be working on the bit last month I’ve worked on the business. Yeah, I’m about to go back into the business, let’s say opening day this month. And we’re really like, I’m doing a lot of new things. You know, behind the scenes, there’s been a lot of growth here a lot of different things we’ve done that you then have to measure that and go sell it I think there’s a time to make the donuts. There’s a time to sell the donuts, and you’re all

Leonard Raskin 09:48

but then there’s a time. No but then there’s a time to say okay, now I’m going to take the proceeds from the doughnuts this thing called profit. And I’m gonna go enjoy my wife and my kids. kids and grandkids are we’re gonna have a great life together. Because at the end of the day, the doughnuts are the facility for life. They’re not life unto itself and for those that they are life unto itself, whether it’s executive, professional business owner, those are unhappy people, 20 years, 30 years later, they’re gonna look back and say what the hell happened to my life. So my pitch is we’re about your life. And we facilitate making the best financial decisions because we know what they are, and how to help you implement them to have the life you want not to have the portfolio you want. I don’t have people that invest money to to see the pile get bigger. It’s for something. It’s to put your kids through college, it’s to spoil the grandchildren. It’s to have that place and attack shelter in Delaware. Yeah, it’s to have that place at the beach. It’s to take your kids and grandkids to Disney World. It’s to travel the world it’s to give

Nestor J. Aparicio 11:00

it is this is the first time in a while I mean, it’s a total shoot interview. You wanna let Raskin Raskin global. Like, if I don’t like to have your hold on, hold on. I, I want to bring this out. Because if people are still paying attention to us, and we’re not talking about sports, or about rocket, right, I’m gonna show him at least this is your novelty item. This is the the Rasky global crab mallet with the beer opener. And every time I show somebody they’re like, if he knows enough about this, he must know something about money. But But here’s how

Leonard Raskin 11:30

you too can get a mallet?

Nestor J. Aparicio 11:33

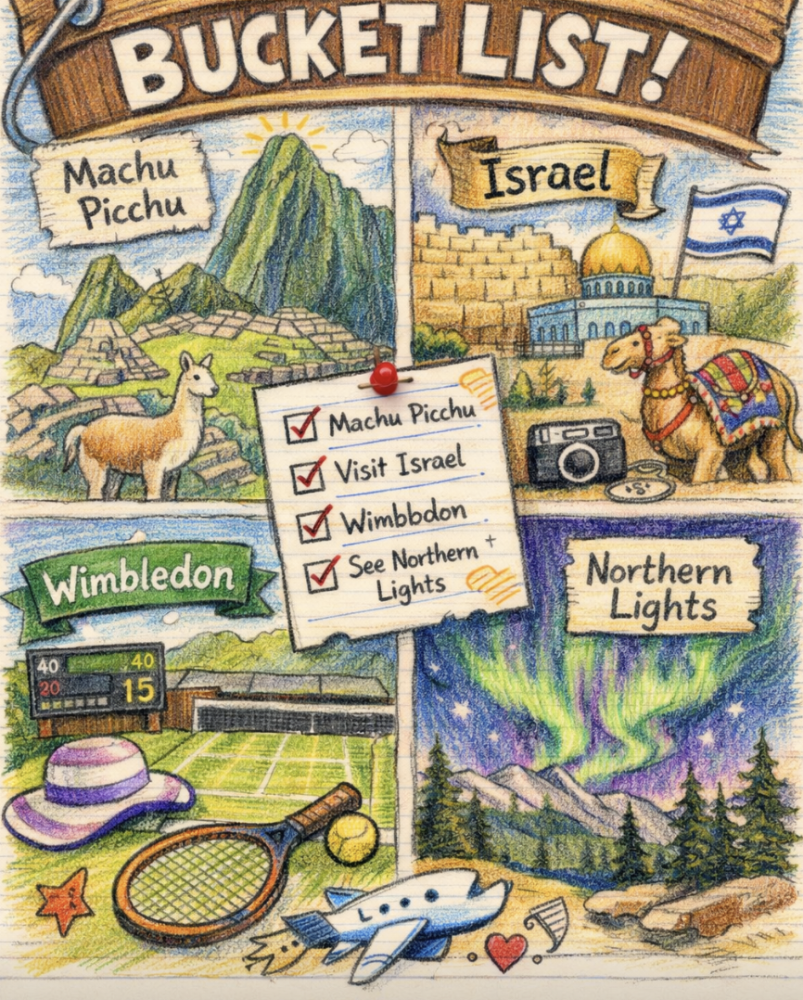

Well, you know, so it’s kind of like a strange month here with the Orioles and sort of this transitional period. And everybody goes through these periods where you’re like, I want to assess this. As you know, this week, I changed my insurance recently, right? Like just auto moving different things. You start to assess all of these things. Yeah, as you get into this. One thing I’ve assessed as I just I had my eyes checked by Dr. Granick. I want to give Brian a free plug here, but I just spent like 1000 bucks just getting new glasses, because my prescription change. He said, Hey, can you see this better? I’m like, Yeah, wow, your prescription change? He’s like, Oh, I’m like, well, that’s 1000 you know, pairs of glasses for you know, reading this, that backup spares, right? Yep. Ya know, like, all of a sudden, I look up and jump, we’re playing total shoot interview here. Luke and I are considering going down to Florida and doing some spring training in a couple of weeks. Not considering I think we’re gonna do it. We’re not broadcasting from there. But we’re trying to like sort of figure out some reason the owners meetings are in Florida. Know, this Mickey Mouse is there. Yeah, have a nice bell Brainware. So the other than that, and because of this Chad steel situation, and just where I am in life with our cat, and whatever, the first time in 25 years, I don’t have a companion pass on Southwest Airlines, because I didn’t fly a lot last year, right? Just working on the business. And my wife’s been going to Paris with her sister, her sister has MS. They’re traveling the world, they’re hiking, they went to Germany. So like, I don’t have a trip on my calendar that’s pleasure based or even, like, concert, Sammy Hagar, the Black Rose or anything like that. And I said to Jen, I’m like, You know what, I’m sort of at peace right now, with the fact that I’m just sort of measuring. And the next time I hit click on a flight to Europe or flight here, or someplace where I’m gonna run around in a bathing suit at my age. For a week, I want to be sure that I want to do it. I want to like be and I’m not into that right now. I mean, they like getting my work done. And yeah, ready for opening day. I’m really, really excited about this new baseball ownership in a way that I don’t know that I ever thought I could be, you know what I mean? Like that sort of, hey, maybe this is gonna be a lot of fun again, and it’ll be fun if it was fun again. But for me, I don’t have that next thing. And I said to Jen, why don’t you go on so far? You got some money, you know, you she said she just got a bonus and this and so wants you in the old go through the thing you want to do? And she said, Well, why don’t you go chase the Northern Lights? And I’m like, well, it’s cold there. And I’m not saying that right now. That’s when you see them. You know it is that decision making time. When you’re like, I’m going to spend a lot of money on a boat, a house at that a bit that you kind of want. And that Lord knows the times I’ve effed up when I bought a condo in Vegas, that never really happened. She really made major financial mistakes. Well, somebody like you around did not just say Do you really need to see Bryan Adams or Royal Albert Hall in London? And what’s that going to cost? And when I look at the pound I’m like it’s not a good time to go to London right now like

Leonard Raskin 14:47

it’s about but that’s what it’s about the the house at Vegas you go is this a good decision? I’ve had people consult again, all kinds of financial decisions. Obviously that’s what we do. but with an eye on, what is financial success? What is it looked like? What does it feel like? What is? What is the thing you would do? And you’re doing it, man, what’s the thing you would do if they didn’t pay you for it? You know when that’s like, one of the things I hate. And this is, this is something I say to clients, some of them get it, some of them don’t. Other than health. I hate the word retirement. It’s a terrible word. Who the hell wants to retire? What are you gonna do, you just gotta lay around and wait to die. No, I like re fire, find something, that’s your passion. If you don’t like your job, find something you love, go do it, I guarantee you, you’ll find a way to get paid for it, if you’re good enough at it. But if you don’t have enough money, great, do something that drives your soul. That’s what it’s all about. And so the book is really about that. It’s about how to how to have, how to grow, how to protect, but mostly how to enjoy your wealth, and then how to transfer it how to how to do your estate plan properly. So, you know, the place in Vegas is a big financial decision. The trip to see Bryan Adams in London is just a life decision. You don’t measure lost opportunity. So

Nestor J. Aparicio 16:18

what you would say to Jen is if you knew her portfolio, let’s pretend that you did. Yeah. And you said, you know, 51 years old, you’ve almost died twice. You and your sister want to do this thing where you go look at giraffes and run around. And oh, good luck out there. As long as you don’t get malaria and get your shots, all your friends go get the shots, goes on a plane, get his ass down there, meet him in Johannesburg, and get out to

Leonard Raskin 16:43

long flight.

Nestor J. Aparicio 16:44

I go. Go WePlay get this now. No,

Leonard Raskin 16:48

just just you got to have a lay flat seat. That’s all you can’t go and coach Well, she might be able to go and coach you might be more comfortable. I can’t go and coach it would kill me. I need a lay flat for that flight. But other than that, just do it. Do it you got enough miles points use them that’s what it’s for. All right, see the other up the miles so you’re

Nestor J. Aparicio 17:10

not a you know, some people think like, I’m gonna bring Leonard in and he’s gonna be like pain in the ass. And my boss told

Leonard Raskin 17:16

me he’s gonna tell me not to spend my money. See, this is the thing a lot of advisors would do that. They would they would want you to keep all your money in the account because that’s how they get paid. You know, that’s

Nestor J. Aparicio 17:30

an amazing like, that’s a pretty basic fundamental thing you just said there. That is pretty fundamental right? Like the more money in the bank. Hey, you know what? It’s funny because I brought this up in the beginning about finding your fiduciary responsibility. Your book is called plug it again, your fiduciary who fiduciary, fiduciary

Leonard Raskin 17:48

real fiduciaries guide to what it means to fiduciary I’m friends

Nestor J. Aparicio 17:53

with a guy who lost a lot of money for me 30 years ago after my father passed away in a way that made me not trust people like you or anybody pays for long laundry, right? So you know, and it’ll, that’ll be in the next book, not the book. I’m really baseball this week. But that’ll be in the book before I dive lice life’s lessons along the way. But there is a point where like, I saw Jeffrey Levitt you put your money bank right? Oh, and this isn’t you know, Jeffrey Levitt was on it is not was is on the cover of American when they put the news American out of business and stripped up goodbye Baltimore. Jeffrey Levitt was the lead stories pictures on the last show long Baltimore, right, literally. So we’re talking about 1980. And like four years later, my father I did that food bank thing couple weeks ago, my father student soup lines never voted before Republican the rest of his life after Herbert Hoover. Yeah, chicken in every pot. My dad stood in the soup line. Didn’t mean to but God like and my dad didn’t dislike Reagan, my dad didn’t even dislike Nixon, you know, but my dad loved Kennedy and he loved FDR. But but but the notion that you don’t forget those sort of seminal moments of Fiduciary Trust, and I think you can’t trust the bank. Oh, core bank, you can’t trust Bernie Madoff because look, no happens there. You know, you can’t put things under the you know, your your mattress.

Leonard Raskin 19:23

Well, you know, it’s funny you say that because it’s funny, you invoke Reagan in this, it’s I’ll just bring up one of his most famous quotes about Russia was Trust, but verify. Now, we reverse that in our world. Our premise is verify, then trust. So you’re talking about the bank you’re talking about made off. You got to verify you’ve got to know what you’re doing first. And and then you can trust. If you trust first you can often be burned. So you better know what you’re doing and here’s what I know. Know, the cost of doing this by yourself or with an amateur is way more expensive than the cost of paying a professional?

Nestor J. Aparicio 20:09

Yeah, well, I mean, I needed advice on insurance last week, I text you, you text me five minutes, I gave it to you like, I want to get a little bit more. So I’m going to cost $18 more a month. And I’m like, oh, okay, like that. That’s the best advice what I’m paying you to give me that advice. Right? And I’ll tell you what, if the issue hits the fan, and some jackwagon and one of these motorbikes that’s running around and one of these, these, you know, these bike gangs hits me. Yeah. And you, takes you out what the advice you gave me was protect yourself from that sort of thing. That’s right. Insurance people. 95 miles an hour on 695. That’s right. They’re clearly racing on a Sunday afternoon. Yep. And on

Leonard Raskin 20:53

the catastrophe, you can’t afford to lose. And the insurance agents don’t often tell you, what you what’s in your best interest because too often they work for the insurance company. And when they work for the insurance company, the insurance company tells them what to tell you. I tell you what you should have want to have, how to protect yourself and then you go to them and buy it. It’s a beautiful combination. But you got to verify and then you can trust and that’s what it’s all about and no matter who’s giving you the advice that’s what you want to make sure of so you don’t get horrible advice and then you don’t put your money under the mattress because you can’t trust on who it is that you’re working with. Alright,

Nestor J. Aparicio 21:35

so anybody out there that’s watching this I’m just verifying and trusting fiduciary who would have real fiduciary will tell you about how to protect grow, enjoy and transfer your wealth. That’s like a regular segment letter that I’m doing like with an author when I put Rick Edmonds book up and talk about his book, ready to transform your wealth into a lasting legacy imagine a future where your wealth is not just growing but thriving under your control letter P I didn’t know you’re in the middle niches P what’s a P stands for?

Leonard Raskin 22:02

You gotta give it a give it a guest one guest and then we’ll go from there. Peter, Paul, the other one I was gonna say it’s Peter and here’s here’s a good one for you. Here’s a good one for you for no one me as long as you have and what we do every week. My the initials the initials right L P are the family and friends that know me well say that stands for long playing record because once I start you know I can’t say hello in 10 minutes so

Nestor J. Aparicio 22:39

if I do shoe is available, you click on Amazon you can go to Raskind globe you go to Baltimore positive letter it’s always around here. We usually talk about hockey or football which we’ll get back to that next week. You know, it really is it’s sort of a slow time right now. I’m upset I mean I’m looking at the baseball schedule so in other playing in Pittsburgh, I can’t do that. Cincinnati so like I’m just chilling out, waiting it out. The ravens are waiting it out and I’m literally much like you we like all of us who are entrepreneurs building a better company right now. I’m really I’m really proud of Baltimore positive and 25 years and the 25 stories of glory and this cup of Super Bowl and all the stuff we’ve done I’m ready to like you grow Okay, that’s it No, so it’s all about let’s do it all right and on Mt. Washington pediatric hospital costs for me to plug that you got to do that sir

Leonard Raskin 23:26

June 3 We’re gonna be out there different place right you’re gonna Hillandale Hillandale? Yeah. To I understand it’s a beautiful place never been for the Gulf been for dinner. Never been for the golf

Nestor J. Aparicio 23:38

I’ll drive you know me I serve I serve good beer and water and hydration I’ll be hydration specialists. You go on to Rasky founder asking global.com his book can be found out on the interwebs he will sign them take pictures he’ll even do that that picture thing we have the ring and you put your finger you know you’re thankful that was always the column this thing when you wanted to be a columnist the paper to you always get

Leonard Raskin 24:05

a picture that I liked that. Yeah, you gotta have a thicker picture.

Nestor J. Aparicio 24:10

I’m just thinking about like, seeing Bryan Adams next week. Just trying to find a couple of concerts. I could go you go before making Keith don’t do it anymore. Nestor I’m still doing it. 25 years into this we are wn SDA and 5070 Towson Baltimore. We never stop talking Baltimore positive ah