Longtime stadium and civic money observer Neil deMause of Field of Schemes joins Nestor to discuss the realities of free money for Steve Bisciotti and The Angelos Family via Annapolis in the bonds that were created last year.

SUMMARY KEYWORDS

money, stadium, orioles, nashville, lease, baltimore, ravens, years, deal, economist, rockets red glare, baseball, neil, team, sports, cities, built, economic impact, steve, pay

SPEAKERS

Neil DeMause, Nestor Aparicio

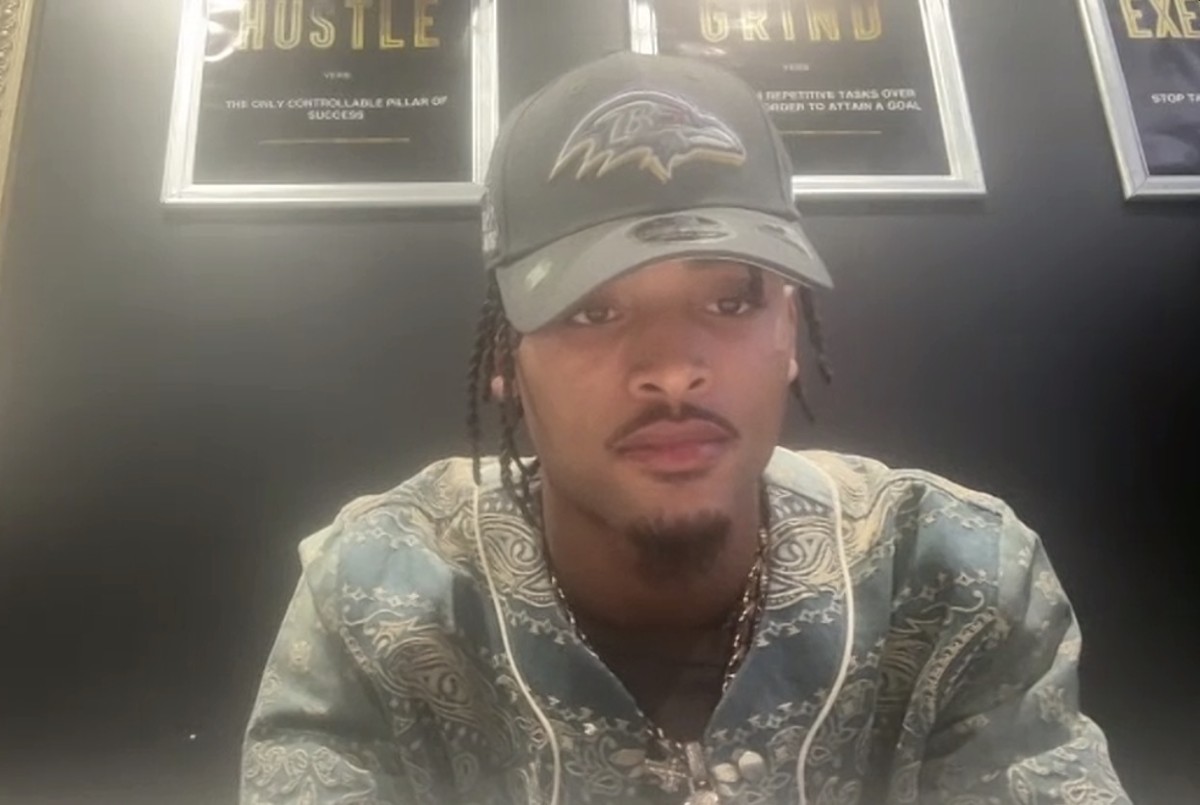

Nestor Aparicio 00:01

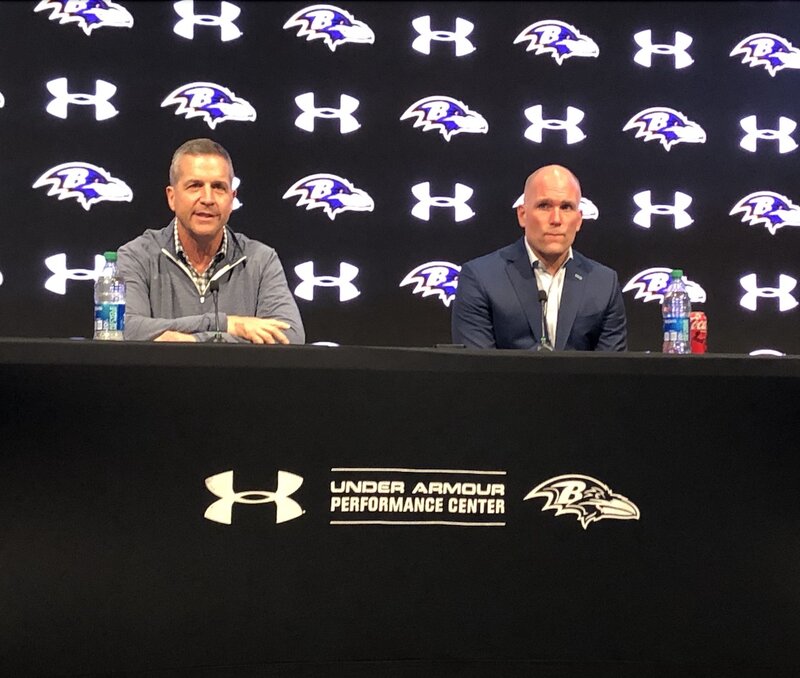

W n s t Towson Baltimore and Baltimore positive still broadcasting and high quality mono sound and am 1570 in Towson Baltimore next week gonna be getting together and doing our Maryland crabcake tour starting the year right with an old friend chi and a Coney Island hot dog and a lot of hot dogs before my trips to Memorial Stadium in Highland town. He has moved his business after three generations out the White Marsh will be there from one until four on Thursday. All the property by the Maryland lottery be given away some holiday cash drops as well as ravens scratch offs as well. And our friends at window nation 866 90 nation 60 months interest free and and five years there isn’t any by two you get two free almost as good as the deal that Steve shoddy got from the state of Maryland in the stadium authority. I have tried to cover all of this obviously as a journalist I have a talk to Steve shoddy many, many times I had been thrown out so I do not get to ask the questions. There were no questions allowed was Sashi Brown and Chad Steele and I actually had a PAM wood on from the Baltimore banner who covered the event on Wednesday to talk about the great news and it is great news that the Baltimore Ravens are gonna remain here for 1520 25 years, whatever that would be. I like football I’ve had a sports radio station here for 25 years this year. If that sports radio for 31 years, I am old enough to remember when we begged for a football team and all Commissioner tangley boo could offer was a museum but lo and behold all these years later, we’re second leasing now with the Ravens. This guy has covered the INS the outs the UPS the downs, the money, the chicane eree to use Vince McMahon’s words and terminology back in the day, at a place called field of schemes.com. He wrote a book a generation ago about where this money goes, and where all that research and civic development and all that stuff happens. His name is Neil DeVos, you can find him at field of schemes.com. He’s a great, great follow out on Twitter on all of these things. And dude, I’ve been following you a long time. And all of these municipalities holding the gun up, whether it’s Oakland, we’re going to Vegas, or St. Louis, and we’re going to Vegas or wherever it’s going to be finally Baltimore made field of scheme. So it’s been a long, long time. Neal, it is a pleasure to have you aboard and and I saw that you were semi critical and certainly where we are. And I’ll just open it up by saying I find you to be sorted equal opportunity. None of these are really great civic endeavors. They make us feel good in our souls for the most part, right? Yeah, I gotta say chicanery expert, I’m gonna start using that I think as my as my bio. So yeah, I’m trying to figure out sort of how bad the new ravens deal is, right? I mean, the line, I always uses it all on what people asked me inevitably, which is the worst stadium deal, you know, all unhappy stadium deals are unhappy in their own way. But um, so, as I’m sure everybody knows, the EA, original announcement last spring, right was that the ravens and the Orioles? Were each going to get $600 million in state money for renovations in exchange for doing lease extensions. And there were a lot of questions at the time about that, like $600 million? For what exactly? Is it just gonna be a big slush fund that they can tap for it anything they like? What? Are they going to build a casino in the parking lot? Things like, literal? Exactly. Right. Um, and so now that finally the lease has been approved, and we still don’t exactly know the answer to all those questions, right. So for example, when you talk about, it’s great that the ravens are going to be staying put for 15 years or maybe 25 years. That is great. But the summary at least that was in the meeting documents didn’t exactly say that it said the Ravens have to stay put. And if they don’t, the state can go after them for unpaid bonds. Right. So that’s the St. Louis plan, isn’t it? Right, exactly. I mean, the concern, right, is that you’re worried that it’s an out clause that just says that, you know, obviously right now, if there’s $600 million in bonds, you know, the Ravens owners aren’t going to want to pay $600 million back, but in year 10, or 12, or 14, or something like that, the remaining debt starts to be less. And at that point, it’s not all that much to pay to leave, or to come back and say, Well, you know, we can leave now and only pay, I don’t know, $30 million, or something like that. Well, if it’s part of the billion dollar plan to go to Paris, paying off 600 million is not a whole lot of money. Sure, but I’m saying as the math gets lower, so that’s a concern. And on top of that, you know, I just posted update about this this morning. And then after I posted it on the site, I thought, you know, how does this compare to other lease extensions, right. Um, and the I think the highest price so far was there was the Pacers a while back agreed to at least extension.

Neil DeMause 05:00

Next stage for a bunch of public money, and the New Orleans Saints, and those who came in around 30 million a year, and this one will be 40 million a year. So if we’re talking about just did Maryland get a good deal for its money? It’s the most expensive subsidy, or at least extension in sports history, at least until next one.

Nestor Aparicio 05:19

Well, Neil, I just want to turn this back to what $600 million represents, right like, it was less than half of that that built the stadium to begin with, right. And that was controversial as hell right. Like, where the purple Barney’s are coming in and art modell and like kicking the dogs, and we stole a team, which we swore we’d never do, because we’re the good guys. And all of this that’s going on. It is amazing. That the Washington the name, I can’t say any more that was associated with the franchise for 100 years that they were such a big animal they were going to go to Laurel Governor Schaefer said you’ll get no infrastructure, they got their junk stadium and was junk when was built was built within a year of the Raven stadium, literally turn of the century. And you mentioned this notion of reopening leases. And I got I got so much I could get to with you. But the reopening of leases is almost a new kind of fangled thing because all of these stadia are coming up now. And the rain was was one of the first ones because it was one of the first finagle moving a franchise kind of thing. Nashville is just gonna blow theirs up right down in Dallas, they blew the baseball stadium up and they built another one, right? So 30 year cycles to say, around here, and I’ll do my Baltimore accent for you, Neil, because I know you’re in New York, right, say, build their thing for them down here, you know, we’ve only been here a couple years can be you’re just brand new. No, it’s 30 years old now. And I’m 54 and I was 24, then, and 30 years in the lifecycle of a stadium is sort of like, the notion would be it’ll be a hunk of junk and 20 years, if there is such a thing in the NFL after what happened to them are handling whether our kids are gonna play this sport, and all of that that goes into it. But the notion that the late 90s birth, these new stadia that this is the time where clock’s ticking, we’re not going to do 30, we’re only going to do 15 We still want to keep that Frankfurt, Germany door open or that London door open for like, there’s only 32 of these franchises. It’s amazing. It’s twice as much money as it took to lower the team here. And to your point, other than me talking about it, because I’m the kicked out journalist and I’m a little cranky. It’s a lot of money. Nobody else is getting this sort of dough other than these 32 cats and maybe a couple of these NBA and and baseball owners when it’s all over the Oakland’s not getting this deal out for baseball for anything, ever.

Neil DeMause 07:44

Yeah, yeah. I mean, when it comes, you know, it is a lot of money. And I haven’t been writing about this quite for 30 years, though it’s coming up, not that far off. And again, when we first started looking at this, my co author and I it was, you know, established that a stadium lasted 30 or 40 years, and now you’re seeing it, the lifespan is considered more than 20. I remember years ago, when the Miami Heat, we’re looking for new arenas, Orlando Magic, looking for a new arena, that doesn’t even matter. There was so many of them, right that, you know, got built not in the 80s or 90s. And then got almost immediately replaced. I asked Rob Ford, who’s a sports economist, you know, what, what do you think the lifespan is of a Stadium Arena now. And he didn’t miss a beat. And he said, If I’m a sports team owner, I don’t see anything wrong with getting a new stadium every year. Right? And that’s kind of thing, right? The only real leverage they have is we’re going to take your team away, or we could threaten to take your team away. Doesn’t have to be realistic, right? The New York Yankees were talking up how you know, we could move to New Jersey or to Charlotte, North Carolina or something. We don’t get a new stadium in the 90s. The New York Yankees are not moving to Charlotte, North Carolina write the entire value of the New York Yankees as they play in New York. But they felt threatened in so yeah, so the I think the team’s owners are realizing that, you know, once you get the stadium, how do you then get more public money? And what you have to do is say, Well, if you want us to extend our lease, and that’s why I’m so concerned about what are the out clauses in the lease, right? Because if you have an ironclad lease, it’s going to last 15 or 25 or 30 years. That’s one thing. If you have a lease that the team can buy its way out of in five or 10, then suddenly, you’re looking at not just $100 million now, but possibly more money in a decade or two and that’s, you know, the even more scary part. And again, we’re talking about the Indiana Pacers the Pacers have made a just racket out of this where every few years they come back and they say okay, we want more money for more renovations. We’ll extend at least a little bit more. And then you know, again, come back another few years after that it’s just been going on and on and on.

Nestor Aparicio 09:54

Socialize the cost privatize the profit. Neil DeMoss joins us here from field of scheme He’s obviously, you know, I can reach you 1000 times and 1000 circumstances when the Atlanta Braves moved out of the city, when Camden Yards empties out where John is going to keep the Orioles here until the rockets red glare and you know who they don’t even know who representation is in New York for the Major League Baseball franchise here for a number of years as to who could make decisions who would want to make decisions, and now they’re dragged into court. And my understanding is their political leaning is to wait for Westmore to run the state, which is old 10 days from now. And they’re going to negotiate with West. But Steve wanted to get this deal done with Larry Hogan. But the tea leaves behind all of this. And again, you study this and I’m going to I before this outward, I’m going to ask you why you’re such a big shot, why you wrote the book and why I come to guys like you on days like this and and you have all of these facts and morsels of information at your disposal sort of in an encyclopedia kind of way. The Orioles and the Ravens and how this relates in our state and what it means in our state and this stadium authority and how the structure is here, right? So the bears are gonna move again out to the suburbs, and they need a dome and they need Beyonce and Jay Z to play like all of that that’s baked into this. Why is this a good deal for Steve shotty to take the 600 million, even though you’ll agree it’s a lot of money. It’s great. And where the Orioles are in regard to this from an outsider who studies this year round. And I’m not going to have anybody smarter than you literally on the show. Because the local reporters here don’t get it right. In general Jeff Barker hasn’t gotten this right. 50 reports which John Angeles 1000. So I really do rely on you to say, Where does this lie in all of this. And I think in my mind, because our stadia were among the first ones, that these re ops, this is sort of setting the bar like they set the bar and quarterbacks and salaries, right, like Steve signed up first. I don’t know that’s why was there a gun on Steve to do this? Now? Why didn’t he wait till 26 or 20? I mean, he could have waited longer to do this.

Neil DeMause 11:59

I mean, I think this is a good deal for him. Right? Clearly, if you’re getting $600 million, you’re still paying no rent, you’re still not sharing any of the stadium revenues, you’re just paying for operations and maintenance. You know, that’s clearly, you know, something that no team owner is gonna pass up. And again, we don’t I haven’t seen the lease. So I don’t know exactly what’s in it. But there’s, you know, I’m certainly concerned that if operations and maintenance is something that the Ravens have to pay, and now they’ve got this big slush fund to pay for, you know, improvements, you know, can they just let something fall apart and then say, Oh, we got to tap that slush fund in order to in order to replace it rather than actually paying to maintain it. Again, this is something that would be good to see the lease to see what’s actually required in there. But you know, I mean, I think this is a great deal for him again, it’s a record amount of money per year for lease extension. And you know, I think it will kind of set the bar for for other for other cities, which is again something that I’m concerned about,

Nestor Aparicio 13:01

Neil, take it to the baseball side and I had Pam wood on earlier and everybody who has Baltimore positive and visit that and see me talking to Pam from the Baltimore banner about this because she did cover it and you know, the the Ravens were no speaky and Chad and Sashi with their will tell you later to your point you call it a slush fund. That’s fine. Just call it you know free money is literally what it is for the Orioles to not do a deal now not have a deal now in your mind in not playing the rockets red glare and he would never take the team in any of that BS that I don’t believe any more than Howard balls are believed that that the Cardinals or the Rams were gonna stay in St. Louis, I’m back to the Cardinals. I’m two feedings ago for the poor St. Louis people, they still have great Frozen Custard there. The Orioles are, are they more valuable without a lease than if they were tied into a 1520 Whatever long term lease in Baltimore, given the demographics given the stadium, given where they are giving the American League all of that bakes into it? Are they a more valuable property with a lease or without a lease in your mind?

Neil DeMause 14:07

I think they’re more valuable property with a lease and $600 million. Right.

Nestor Aparicio 14:12

I forgot that part. I left that,

Neil DeMause 14:13

you know so I mean, it’s not like you know, the the Orioles would be more valuable in I don’t know Nashville or someplace like that. Right. And this is the thing about baseball is that unlike football, where you can put a team pretty much anywhere as long as they show up on TV because all the money in footballs, basically from national TV money and ticket sales, right? But every team sells out. So it’s not a huge distinction. If so, if you look at the the revenue numbers across the NFL, they’re not the variance isn’t that enormous. Whereas in baseball, you know, the Yankees genuinely do make a ton more money than the Royals, you know, and the Orioles are sort of towards the bottom of that because Baltimore isn’t the biggest market. But baseball is on a really good job of building all the big markets. So where else would they go? You know, I don’t think And even more valuable in Nashville, especially, since they would have to build an entirely new stadium there. Or, you know, any of the other Montreal, you know, it’s, there’s not really a lot of a lot of better options. So I think the best option for the Angelus is is absolutely, to take the $600 million and run with it as to why it hasn’t happened. I mean, you know, it could be his organization with the within the organization, it could be, because there’s differences between the two leases, right, because of the times and the IRS rules around when the Orioles sign their lease and the Raven sign there’s the Orioles pay rent, but not maintenance operations, the Ravens pay maintenance operations, but not rent. So and I know that one point, the Orioles are trying to challenge that and didn’t get anywhere the courts. But you know, who knows, they may

Nestor Aparicio 15:49

be interesting was always I get what they get, whenever they get I get structure,

Neil DeMause 15:54

it’s basically the same amount of money they’re paying, it’s just paying through a different mechanism. So but they may want to change it around to, you know, to change it to being paying maintenance and operations, which again, wouldn’t necessarily be worse for the state. But, you know, if it creates loopholes, where they can, where they can skimp on maintenance, instead of you know, rent is rent, right? You have to pay it. So again, it’s there’s a lot of unknowns here that aren’t huge, the basics we know, which is, you know, $600 million, in exchange for just continuing to play where they always have played and where, you know, they, they almost certainly wouldn’t leave these there aren’t better options. But there are a lot of details that we don’t know, I mean, you know, the thing that drives me crazy about all these lease negotiations is that cities in the states never seem to realize the leverage that they have, right? I mean, Maryland could go to the Orioles and ravens and say, you’ve got a good deal here. You’ve got stadiums that are failing you, you’ve got a good fan base, you know, you’re making

Nestor Aparicio 16:52

$300 million a year and you’re off your franchise

Neil DeMause 16:56

for 575 minutes worth 5 billion. Exactly. You can afford to buy new televisions dude, right? You could go and say, if you want to continue to stay, how about you start paying some rent? How about you start sharing some of the revenues? At least start from that you’ve

Nestor Aparicio 17:12

gotten rich off of this during this course of this time, right? And

Neil DeMause 17:16

then let them bargain you down, right? But at least if you’re if you’re trying to do any negotiation, right, you start by asking for what you want, and then you negotiate down to what you can get, it seems to

Nestor Aparicio 17:25

wonder what the hell they wanted, when they got a billion to add it to both the teams. I wonder what they asked for?

Neil DeMause 17:31

It seems like they I don’t know what they asked for. But it seems like they, you know, they got everything that they that they wanted. Again, we’ve seen this before we like you mentioned with the Rams, I spoke to someone years ago who had helped negotiate the Rams deal with St. Louis. And he said that his boss was was constantly throwing it, oh, let’s ask for this. Let’s ask for that. And he was like, they’re never gonna give us that. Let’s try worst we can do is worst they can do is say no. And they said yes to everything. That’s just the negotiators for the public side are very, very bad on this. And the one other point, I wanted to say when you were asking about why now, you know, there is a lot of money, public money floating around right now. Right? You know, you’ve got infrastructure money, you’ve got the COVID relief money. So states and cities are feeling a little bit more flushed they might have a few years ago. So it’s a good time to sort of strike while the iron is hot and say, hey, you know, you want to put some money into, you know, an investment in future business for your community. Right? How about you throw 600 million or you know, 1.2 billion, or really, it was like, I think it’s 1.8 billion if you count the money that was for infrastructure around the commander Stadium and the minor league baseball stadiums in the entire package. So we’re seeing a lot of that now. You know, I mean, 2022 was a record for billion dollar deals and sports, and was a record for billion dollar deals, honestly, in other forms of corporate subsidies, right, you know, computer chip plans and auto plants and things like that. So and I think that’s not unrelated to the fact that when there’s public money sitting out there, you know, the lobbyists are gonna be the first ones to sort of try and grab at it.

Nestor Aparicio 19:01

Neil DeMoss is here. You know, I would say my background is being a journalist in the 80s. And I was young, I was 1819 20 years old, chasing girls and rock and roll in the history hammer Jackson. I’ll never forget an interaction I had with my boss, Jack Gibbons, who was the sports editor at the Baltimore Sun evening sun at the time. And I went into him at one point and I think Ken Rosenthal was involved covering the Orioles and they had just sort of announced Camden Yards, Ebert, Bennett, Williams was going to put a shovel in the ground, and I said something flippant that a dumb 19 year old from Dundalk would say to my boss, I’m like, this is a sport who cares about any of that? And he looked at me and he and I don’t know that he knew when I was 54. I’d make a 30 year career of doing this and being the one guy left here that’s going to do a segment like this and actually ask where the money’s going and like all of that, but you come at this differently. I want to give you a little oxygen to talk about because I’ve been hearing about your For a quarter of a century, I think you may have been on my syndicated show a million years ago, writing about this type of stuff. You began as I want to say, economist, book writer, professor, but give me your background in this space because there aren’t 10 Guys like you like or gals I could call into you have a partner as well, that I can call in this space that would have the depth that you do this professionally. And you’re on this all the time, when it comes to where public money is going in regard to sport around the world, literally.

Neil DeMause 20:29

The irony is none of starters, none of those things, right. I’m not an economist, I took one economics class in college, I had not written any books before field of schemes. I’m certainly not a professor of anything. I started as just a journalist and a sports fan, right, as did John Kagan, my co author on the book. You know, we were both people who are like, fans of sports fans of teams concerned about the fact that oh, you know, it seems like team owners are getting an awful lot of money from cities that can’t really afford it. What is this new trend that we’re seeing someone called the original sports washing? Right, literally? Yeah. So so we were like, well, you know, and so we started looking into it, realize it was going on all over, wrote the book and thought, wow, we’ve you know, we really managed to sort of tap into this moment in history, right. I think we even said this to our publisher, you know, we’ve got to put this book out, because this is a time the 1990s We’ll never see again, when, you know, sports teams are, you know, raking in all this public money. And I did not expect to still be discussing this in the year 2023, I did not think that the the same deals will be going going down. But yeah, I mean, at this point, you know, eventually you cover it enough. And I’ve written about this for, you know, for The Village Voice and defector in vice, and all sorts of different places that, you know, over the years. But you know, eventually you sort of start learning and becoming an expert, you know, did not expect to become an expert on tax exempt bonds. But eventually you have to as a journalist, you know, figure this stuff out. And there are other people out there doing good jobs. You know, I don’t want to say that, you know, you and I are the only ones looking at this. But you know, the state of journalism today, as you well know. And as anybody who reads what’s left of newspapers and websites, well knows, right, is that there are very few people with very little time and very little expertise, who really just are told, you know, go out and write six posts today. And if it’s just a matter of reprinting the press release from the team, then that’s fine. Do that and move on to the next thing. So I do feel for the journalists who are doing a crappy job of, you know, covering this stuff, but really, somebody has to be doing it more because there’s an awful lot of money at stake. And you know, it’s just crazy to think that nobody is doing oversight and this beyond saying, oh, you know, lease extension good. The ravens are gonna stay a

Nestor Aparicio 22:44

couple things. I got mouthy. When this came out and I shared your piece on Wednesday night, somebody got mouthy on my thread. Imagine that. The old sports radio, taking phone calls from everybody analyzes these things. You know, when they come out. There’s always an economist that is a part of Dewey Cheatham and Howe. And they’re going to come out with the economic impact of the millions of dibba and the Jay Z concert in the hotel nights in the amusement to the amusement and the value of the red, white and blue lights that we have there for the civic pride of our community and like, blah, blah, blah, blah, blah, all of that. The stadium has been here for 30 years, I lived downtown. This was my view for 19 years. I lived at the Inner Harbor, and I left. My last name’s Aparicio. I came here off a boat from Venezuela. Like baseball 60s. That’s why I’m, I’m a sports guy always have been my whole life. I love it. I was the first guy dig a shovel and welcome art. Come on in. We’ll put on purple. We’ll put purple flamingos up on the lawn where we love purple. You know, I’m that guy. I’ve built the life out of that. But there is a point in all of this where I do wonder what if the Ravens never came? What what would have happened to our city? Would we be like Sacramento? Would we be a one pony? Would we be like Portland? Would we would we be diminished? Would we and my Charlie Ekman voice will we not be big league we’re big league town. We’re Major League town. We’re in the minor leagues. And we have minor league hockey here we had soccer like I’ve lived through all of we lost the bullets in the 70s My dad hated a Poland over that forever. But the analysis always seems to come out and say well, there’s economic impact and getting the all star game or getting the Final Four or all these Super Bowls that I go into every year. And I see them come to life for like 72 hours and it all goes away and it’s not what they sold to the local that they would sell more wings or pizza or beer or whatever is being sold. I am into both of these stadiums and I tell you what the Orioles they’ll lamination of the brand and seeing Red Sox and Yankees fans boasting by the 10s of 1000s in the arts and seeing living in the city and seeing what a steakhouse look like. I can what a restaurant look like and what the hotels and convention like all of that. I, I know I love it. I know on parade days, it’s a great value. I know we all have a affinity for this and it says Baltimore on it. But I don’t know if it’s a good deal or not, Neil, I really don’t. But I know there’s an analysis that will say, the greatest economic impact ever. That’s why Steve just got $600 million. Who’s doing these studies? And are they on the up and up?

Neil DeMause 25:26

Consultants? Right? I mean, consultants are working for the teams, right? So it’s basically they’re being paid to show why it’s a good deal. So those things are not and I know, people who’ve worked for them that, you know, they’re not they start with the, with the $600 million number, right of how much money you’re getting, and then say, work backwards and show how this were worth $600 million to the to the state. So those numbers are, are garbage, basically, you know, because they’re depreciate, you’re

Nestor Aparicio 25:51

saying just garbage is rubbish.

Neil DeMause 25:55

It’s not meant the PR documents, right? They’re not meant to be serious economic analyses. It’s not like they’re sat there sat down and said, you know, sit down and tell us whether this is going to be a win or a loss or breakeven, it’s show us how this will will be good. When economists actual economists who aren’t being paid by the by the team look into it, they find that the actual value is somewhere between nothing and not very much, right.

Nestor Aparicio 26:22

Really not? Literally not very much. Yeah.

Neil DeMause 26:26

I mean, there’s, I’ve heard a couple of economists say that the best way to determine the economic impact is to take the official projection and move decimal point Overwatch, you know, so it’s about 10% of what they claim. But, you know, there’s there’s certainly cities that, you know, have built new stadiums and seeing no economic impact, because, you know, if the Ravens were not in Baltimore, and there was a time when the raiders were not involved anymore, and it’s not like people in Baltimore didn’t, you know, didn’t do things right. They may have gone to other trouble Oriole games, they may have gone, you know, out to dinner more who knows what they did with that money. But, you know, one of the things

Nestor Aparicio 26:59

they did when they stopped going Orioles games, which everybody did for 25 years, right?

Neil DeMause 27:03

So so you know, and you know, look, I love sports, I came into this as a sports fan. I am still a sports fan, despite knowing all that I now know. But when you look at this, you mentioned Portland, Oregon, right? Portland, Oregon, famously did not build an NFL stadium in the 70s, when they could have gotten an expansion team, and still does not have either either football or baseball, or hockey. And they you know, Portland is is tremendously successful at what it is right? You know, it’s attracting lots of new people, it’s, you know, expanding, you know, it’s considered a good place to live, despite the fact that they it doesn’t have a lot in terms of sports. So there are lots of different ways to be a successful city, I guess, is the answer, and lots of different ways to be an unsuccessful one. And, you know, I think if you ask any economist, should you spend $600 million on renovating a football stadium, they would say you could pretty much do anything else with the money and it would be a better investment.

Nestor Aparicio 27:59

Well, they didn’t do it in San Diego didn’t do it in St. Louis. You know, Vegas got sold off to the Gypsies in the wolves. And for you municipalities that want it. And by the way, Neil DeMoss is our guests. He’s at field of schemes.com You can read all of his work along with David Hayward all these folks that do the good work that you do up on your site as well. Nashville last topic for you because you sort of just breezed by while the Orioles who lease in Nashville and until the rockets red glare, and John wears his cowboy boots and actually lives in Nashville. And they got guys named Garth there that don’t even need a last name. They just last time I even saw your site a couple three months ago, whatever it was, is the Nashville bigger better deal that they put on there that they’re going to have concerts and hotels and CMT. And you’re like, No, they’re not. They’re gonna have the same stuff they had there before. And I remember reading that about and I thought maybe one day you’ll be coming on here. When Steve gets his deal before Uncle Larry leaves Nashville and wherever it is and baseball. Listen, I’m not a doomsday. Err. I am a guy that doesn’t trust the Angelo’s family from firsthand experience, right? Like, I don’t believe a word they say they don’t even trust each other. So and that’s been borne out right. So I don’t believe anything he said. And by the way, that whole rockets red glare thing. I had to hijack a tourism press conference with Christine Brennan, and did Cass and asked that question as a citizen because he’s never available to the media. So that whole statement he made that the print house will be here as long as the rockets red glare and I was the one to ask that question. I and they were never would have been said so it gave him a PR moment. But, but all things being equal. And I mean, God, the guy that moved the Rams out of St. Louis was from Missouri. So I you know, let’s not play that game. For you with Nashville. Why is it not plausible or feasible, other than the other owners wouldn’t allow it and you know, they wouldn’t want it and they Like Camden Yards and why why is Nashville not feasible in your mind not just to steal the Orioles. But to steal the ACE do anything to get a team.

Neil DeMause 30:09

Marcus says, you know market size and the fact that baseball is different from football, right? You can have a football team in Nashville, as I was saying, because as long as you’re getting a cut of that national TV money, you can put a football team in Green Bay, right? You can put a football team anywhere. Whereas with baseball, you really do need to have a bigger market

Nestor Aparicio 30:27

and you can’t put it in San Juan. They try. Yeah.

Neil DeMause 30:31

Look, what could Nashville conceivably have a baseball team someday a Major League Baseball team Sunday possibly. Would it be an improvement over Baltimore? Absolutely not. You know, it’s the same conversation I was having with somebody today about the Tampa Bay Rays and like, oh, they should move to Orlando. You know, I mean, no, they shouldn’t move to Orlando, you know, she get people to Tampa. They’re not doing great, great and St. Petersburg. But they would do even worse in Orlando. And I think that’s the same situation in Baltimore. The Orioles are supported in Baltimore when they’re good, and they may actually be good again sometime soon. You know, I they have a lot of good young players. They, you know, don’t keep signing guys like Jordan Lyles, and Kyle Gibson, you know, actually put a team around them, they might actually have, you know, have a shot at something.

Nestor Aparicio 31:16

It’s not a trend. That’s not a bug. That’s a feature. You know, I mean, you mention and every Doug Dre back and I did I could take you through them all.

Neil DeMause 31:25

I can say they have a better shot than they did during the Chris Davis years. So anyway, I don’t think it’s impossible. They were moved to Nashville. I don’t certainly don’t think it’s like, oh, well, the Angeles is would never do that. I just think that you have to take seriously. You know, what a team be successful, more successful in Nashville, and then Baltimore? And I think the answer is no. Okay. Well, fair enough.

Nestor Aparicio 31:45

And I really appreciate your time. It’s great having you won. I would send anybody out to follow your work. I critical LY is that fair? Che you’re a critical eye in all of the stadium and arena and civic money games.

Neil DeMause 31:59

I’m a critical eye with a sad tear dripping out of one corner. amount of time that we have to keep doing this.

Nestor Aparicio 32:06

Is that because you’re a Mets fan or no.

Neil DeMause 32:09

There’s that as well.

Nestor Aparicio 32:12

Neil, I appreciate you. Thanks for beginning our year with some great great information, some great, great insights and Steve shot he $600 million. I was gonna say billion 600 million. The franchise values are crazy, too. Right? That’s its own thing as to Steve buying it for 575 I had Pam Ward on I was with Pam Labor Day because I had Governor Westmore he was going to be the governor was very clear at that point. And that day, we talked about what that we were talking about the franchise being maybe worth three and a half billion because we thought the Washington branch offices were five these things go up pretty excellent. It’s really is an amazing amount. He’s his the valuation of this is going up twice the amount of money that we’re giving him literally in six months.

Neil DeMause 32:54

Yep, it’s a great scam.

Nestor Aparicio 32:58

It’s good work if you can get it appreciate it near the most out of field escapes. You can find me with a barrel of crab cake tour next week we’re going to be at G and a Coney Island hot dog. We’re going to jump It’s a hot dog and crab cake tour. We’re gonna be giving away Summer lottery scratch offs as well as our friends and window nation helping us support all that we’re doing into the winter. I am Nestor we are wn St. am 1570, Towson Baltimore and we never stop talking Baltimore positive